Owning a car has become a necessity than a luxury and as the purchasing power of people grows, the demand for cars and bikes will rise especially in an economy like India.

But that said, Car is a very expensive product that requires a lot of money to buy. The starting price of a car ranges from lakhs to crores.

There are various manufacturers offering 5-seater to 9-seater car options with advanced features. With countries being conscious of Climate Change, all manufacturer is launching their Electric vehicle models for the customers.

The problem with this is that Electric vehicles are a costly affair even after an Electric subsidy, meaning purchasing an ICE Vehicle is much cheaper than an electric vehicle, however, the running cost of ICE is much higher.

When the vehicle is costly, the best option to purchase the vehicle is to get it financed from a bank. After paying the down payment of at least 10%, and rest you can finance and pay the rest amount as EMI.

But you might ask a question why should I pay interest when I can simply save the money and purchase the car?

Well, that’s what we will answer. In this article, we will discuss the Benefits of a Car Loan, Why You Should Always Finance your Car Purchase?

But before that, let’s discuss why you Should not buy a Car with Cash.

Table of Contents

Why You Should not buy a Car with Cash?

Buying a car is a costly affair and needs your to save constantly if not buying the car on finance. The minimum amount for purchasing a car in India is Rs. 4 Lakhs/- and goes up to multiple cores.

For some people saving this amount could take many many years to ease the purchasing finance is the best option.

You can finance a new car at a relatively cheaper rate, most car companies have in-house financing which allows you to get an attractive interest rate for the purchase of the vehicle.

The interest rate for purchasing a car ranges from 8.5% to 11% and depends on your CIBIL score profile. With a good profile, you can get 8.5% interest in purchasing the vehicle.

Now, what if you have the money to purchase the car with cash, well then also it is recommended to purchase the car using finance.

When it comes to money management and building a good profile background, two factors are very important, which are as follows-

- Cash Flow Management

- CIBIL Score

Cash Flow Management

Cash Flow Management is the amount that is circulated right from the income (Money comes in) to the time it leaves your pocket or Expense (Money goes out).

We all have budgeting requirements to meet our daily needs like groceries, bills, etc. these items are considered an expense and are fixed for a month however, there is the variable expense as well which varies from time to time.

If you want to build a good profile and wealth, then the right strategy to do is to manage the Cash Flow. If you can manage the cash flow, financing your lifestyle becomes so much easier.

with Cash Flow management, you can track your money efficiently and create a system for yourself wherein you’ll you can smartly allocate the funds for various expenses, investments, savings, etc.

When you purchase a car with cash, the biggest hurdle that you’ll face is a disruption in your Cash flow Management because you purchase a big ticket purchase with cash.

The cash you’ve invested in purchasing the car could have been used to invest in an asset that puts money into your pocket like bonds, the stock market, etc.

CIBIL Score

CIBIL Score is the score issued by credit rating companies to the individual based on his/her historic credit report.

Banks see credit and loan business as risky hence, to evaluate the right candidate for giving a loan, the banks look at the credit score of the individual along with the bank statement to evaluate whether they are capable of the loan repayment or not.

If you want to have access to finance, then repayment of the loan is very important. If you have a low credit score, you still can get a loan but with a higher interest rate.

The good thing is that you can always improve your credit score if you plan your finances.

The Calculation for Smart Vehicle Purchase

Let’s say you want to purchase a vehicle with an on-road price of Rs.12.29 lakhs/- now, let’s say you’ve made a down payment of Rs.2.29 lakh/- and the rest Rs.10 Lakhs/- is a car loan for 5 years.

Then at an interest rate of 9.5%, you can calculate the Car Loan as follows-

The EMI amount per month charged is Rs. 21,002/- with the total amount payable coming out as Rs.12,60,112/-

You can increase the down payment or decrease the tenure which is to change the EMI, and the total amount payable and vice-versa is true.

But, financing your car is not fruitful if you do not follow a strategy for wealth increment.

Grow Your Finance While Purchasing Vehicle

Much popular belief is that a car is a liability that takes away money from your pocket and it is true to some extent but, if you plan it long-term and with strategy then you can even make money out of this.

The very important thing is to always purchase a car that has good resale value. The second thing is to have a good CIBIL Score and last but not least is to be patient.

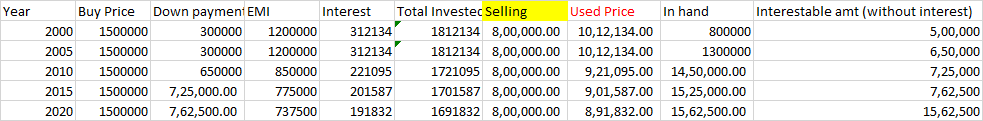

Let’s say you’ve purchased a car for 15 Lakhs and after using it for 5 years selling it for 7 lakhs, then the amount that you get i.e. 7 Lakhs is the cash in your hand.

You should divide the cash into 4 and 3 lakhs and further use 4 lakhs for investment and 3 lakhs for the downpayment of a new car.

You can continue this process every 5 years and you’ll notice that the amount that you invest in tools like bonds not only pays you a return but also makes your principal amount increase.

After successfully applying this strategy 3-4 consecutive times, you’ll have an investment fund paying the returns such that the new car that you are purchasing will be paid up by the investment funds.

Meaning the EMI that you have to pay is paid up by the investment tool also, you can continue it until your retirement age and you’ll see not only you’ve enjoyed the benefits of having a car but also build up a corpus that you can invest, enjoy, pass it to children, etc.

The above calculation has a lot of presumptions about the value of the car, the car sold price, the downpayment, etc. Also, the interest earned is calculated after the maturity of 5 years.

The above chart shows that within 20 years, you can make a car pay for itself also, the enjoyment that you’ll get from experiencing a new car every 5 years is something that cannot be matched.

At the end of the 2020 cycle, you are left with 15,62,500 (excluding the interest that you’ll earn on the investment). If you add the interest that you earn at the end of the 2020 cycle then the final amount that you’ll have in your account is Rs.25,65,857/-. Further, you can continue this process by increasing the downpayment every time.

On average a person drives for 45-50 years in his/her lifetime so repeating this cycle every 5 years helps you in accumulating a corpus and at the same time enjoy the benefit of a new car with the latest technology.

Benefits of Car Loans

The following are the benefits of a car loan-

- Increase the purchasing power of the individual hence, the person can opt for higher priced car

- Build up a credit history by financing a car

- Improve budgeting and helps you in managing your cash flow. With access to the EMI option, you can repay the loan with ease by paying out in easy installment

- No collateral is required for purchasing the car, you can simply visit the showroom with documents and get your loan approved within minutes and take the car home

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.