The Union Bank of India was established in the year 1919, in Mumbai, the financial capital of India. In over a century of service, the bank has more than 4200 branches spread across the nation and has experienced profit in each year of operation. The debit card offered by the bank is an example of its innovative service.

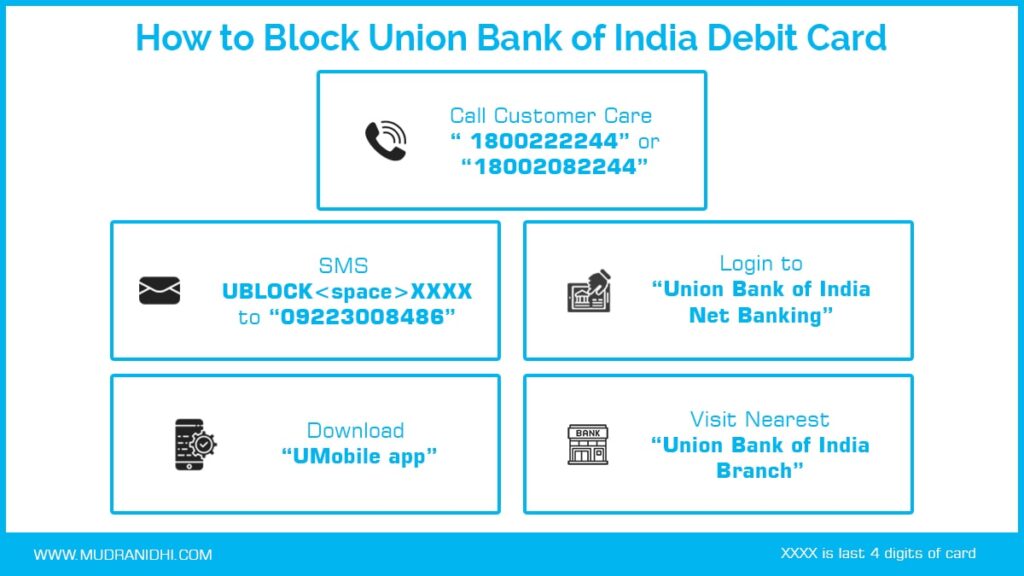

The Union Bank of India debit card has green PIN facility where no PIN mailer is needed. The card has multiple account access and at a single moment, a customer could have access to up to three accounts associated with a single card. In the instant of Joint Account, the customer has the option to issue add-on cards. The Usecure registration guarantees safe online transactions. There is also free insurance against accidental death. The hot listing process of the card is also easy and can be achieved through SMS, mobile banking, internet facility, customer care number, and visit to the local branch. Continue reading the article further to know the various processes to block the Union Bank of India debit card.

Table of Contents

Block Union Bank of India Debit Card through Customer Care Number

Union Bank of India has generated two customer care numbers 1800222244 and 18002082244 which you can access 24X7. So, any time you need to hot list your debit card, you just need to call on these numbers irrespective of the time of the day to have your card blocked instantly.

Block Union Bank of India Debit Card through SMS

The SMS Banking offered by Union Bank of India is a safe and convenient service. You can register for this service by contacting the branch or calling the customer care service number. Just remember to keep your debit card number or your account number handy with you at the time of requesting for the service. Once registered, you can do a number of banking activities with SMS Banking like balance enquiry, mini statement, ATM locator, branch locator, cheque status, and the blocking of the debit card.

For each individual service, there is a specific format to be followed. To block your ATM cum debit card you need to send the message in the following format

UBLOCK <space> Last four digit of debit card Number to 09223008486.

For example, send the SMS in the format UBLOCK <space> 1234 to 09223008486

Block Union Bank of India Debit Card through Mobile Banking

The Union Bank debit card holder could apply for mobile banking facility (UMobile) through the sign-up option of the application, through branch, on the website, or at any of the Union Bank ATMs. The UMobile app could be downloaded from any app store and used on the go. The mobile banking facility could be used for a number of banking services like checking cheque status, getting mini statement, fund transfer, mobile recharge, and the blocking of your debit card. You could hotlist your card by logging into the UMobile app and going to the block card option in “other services” and entering your mPin. The debit card associated with the PIN number would be blocked instantly.

Block Union Bank of India Debit Card through Internet Facility

The internet banking facility of the Union Bank of India allows you to engage in banking activities from the comfort of your office or home. You just have to know and use your internet bank ID and password to do hassle free transactions 24X7, view bank account details, fund transfer, utility bill payments, air and railway ticket booking, and to block your debit card in case of card loss.

Block Union Bank of India Debit Card through Local Branch Visit

The local branches of the Union Bank of India perform all the regular banking activities to help the flow of customers walking in. In case, you are near the local Union Bank of India branch, then you can walk in with the required documents to get help with the card-blocking process. The friendly staff of the branch would instantly block your debit card once they receive your written complaint.

Make sure to check the Union Bank of India Account balance to ensure that the bank remains intact and no misuse has been done.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.