NEFT is a very popular method of payment transfer which is available to use both online and offline account users. NEFT stands for the National Electronic Fund Transfer which is regulated by RBI. RBI keeps the timings, charges updating from time to time. In this article, we will discuss the new NEFT batch timings, NEFT Charges and the limit.

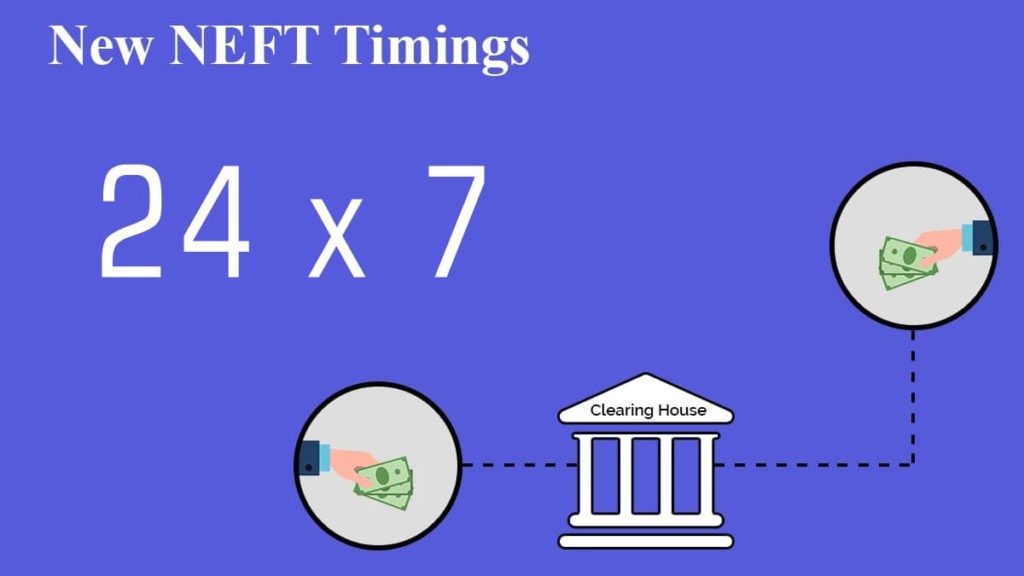

NEFT Timings are set by the RBI as it is the central clearinghouse responsible for undertaking the payment transfer. Earlier NEFT was carried out in 23 batches from 8 AM to 7 PM, each batch consists of half hours gaps and except Second/ fourth Saturdays and on Bank Holidays but RBI has announced NEFT transfer to be available 24 X 7 from December 2019.

Table of Contents

What are the NEFT Charges?

RBI does not levies NEFT/RTGS processing charges and time varying charges on banks from 1st July 2019 although banks may still charge to their customers.

What is the Transaction Amount Limits in NEFT?

NEFT Transaction has no limit set by RBI, You can transfer from Rs.1 to no upper limit. However, the bank has a NEFT Transaction limit which depends from bank to bank. You can contact your bank to know the transfer limit for NEFT Transaction.

How to Make NEFT transactions?

NEFT Transaction can be done online as well as offline. For the online method, you have to use the Net Banking facility of the bank and for the offline method, you can use form.

Online NEFT Transaction

For the online method, a user sender must have a net banking access which is provided by the banks on the request of the net banking facility. To avail the net banking facility on your account you can contact the bank. To transfer the funds you can follow the steps to transfer your money using NEFT via Net Banking-

- Log in to your Bank Net Banking portal

- The transaction process can be done in two step process of adding beneficiary and fund transfer. However, if you have completed the first step for an account then you need not required to add the beneficiary

Add Beneficiary

- The beneficiary can be added by going in the profile tab and go to manage beneficiary link.

- Select the “ADD” option provide the beneficiary details like name, account number, address, and Inter Bank Transfer Limit.

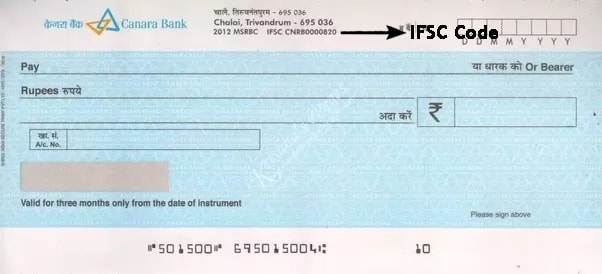

- Enter the IFSC Code of the bank, you can find the IFSC Code of your bank branch here.

- Accept any term and condition and confirm the process.

- An OTP will be sent to your Register Mobile Number, enter the OTP to authorize the process.

- The beneficiary will be added maximum within 16 hrs. After beneficiary is added then you can transfer fund.

Fund Transfer

- Click on Inter Bank Transfer link in payment/transfer tab

- Select the transfer type- RTGS or NEFT (in this case, NEFT)

- Select the beneficiary from the list of Beneficiary displayed.

- Enter the Amount of money you want to transfer.

- Accept any term and condition and confirm the process.

- An OTP will be sent to your Register Mobile Number, enter the OTP to authorize the process.

- The amount will be transferred to the beneficiary/receiver within 30 minutes.

Offline NEFT Transaction

Offline NEFT Transaction can be done by visiting the branch. You have to fill the NEFT/RTGS from that will be provided by the bank. You have to fill all the details of the receiver bank account like name, account number, Branch IFSC Code etc.

What is IFSC Code?

IFSC Code stands for Indian Financial System Code, it is a tool used by RBI to locate your bank branch to facilitate the fund transfer. This enables the fund transfer faster as well as error free. IFSC Code is an 11-digit alphanumeric code which is unique to every bank branch. There are a total of 1.4 lakhs + IFSC Code in India each for bank branches.

The first four letters of the IFSC Code is the Bank code followed by ‘0’ and the last 6-digit is the branch code. For example- The IFSC Code of SBI CPPC Branch is SBIN0004475, here “SBIN” is State Bank of India code followed by “0” the last 6-digit is the bank branch code i.e. “004475”.

How to know your Bank IFSC Code?

IFSC Code is an alphanumeric code having 11-digit character. You can find the IFSC Code in your bank passbook as well as cheque book. However, you can also find this on RBI website or call your respective bank branch and ask for IFSC Code but a suggestible method would be to use the Bank IFSC Code finder which helps you in finding the bank branch IFSC Code.

Other FAQs on NEFT

NEFT Transaction can only be done by the banks that have been approved by the RBI. There are a total of 206 banks that support the NEFT Transaction. The list of the bank that supports NEFT transaction can be found on the official website of RBI- List of banks Support NEFT

The beneficiary can get amount credited to his account within a time limit of 30 min- 2 Business hour.

If the beneficiary did not receive fund even after the time limit of 2 business hours then contact the bank CFC (Customer Facilitation Centre) of your bank. If the issue is not resolved then you can contact the NEFT Help Desk (or Customer Facilitation Centre of Reserve Bank of India) at National Clearing Cell, Reserve Bank of India, Mumbai.

No, you cannot send any funds abroad as you can only use this system within India. However, you can send money to Nepal under the Indo-Nepal Remittance Facility Scheme.

Yes, you can use NEFT to transfer and receive from NRE/ NRO account within the country. However, it is subject to the adherence of the provisions of the Foreign Exchange Management Act, 2000 (FEMA) and Wire Transfer Guidelines

Yes, you can track your NEFT Transaction with your Unique Transaction Reference Number (UTR) which is issued at the time of the fund transfer. You can contact the bank or its CFC to know the status of the NEFT Transaction.

NEFT has many advantages over the other method of fund transfer-

• NEFT is an electronic method for transferring fund, therefore, does not require any physical instrument to send to the Beneficiary

• NEFT can be used online so, you can transfer fund at the comfort of your home.

• Secure method to transfer fund

• Fraud, theft, and error-free method of transferring fund.

• A very cost effective way to avail this facility.

• Credit confirmation will be sent to the remitter via SMS or e-mail.

An NEFT Stands for National Electronic Fund Transfer which is a payment transfer system operated by the RBI. It provides a fast and efficient payment transfer system that can be used both online as well as offline.

If your fund transferred gets canceled then your amount will be refunded to your account. If the amount does not get reflected our bank account within 2-3 hours then you can contact the bank. If the bank cannot help you with it then you can contact CFC. You can find the CFC Contact details from official RBI CFC Bank List

If you did not receive my refund after the cancellation of the NEFT then you can contact the bank and raise this issue. If not satisfied then you can contact the bank CFC the details for the Bank CFC can be available from the official RBI CFC Bank List.

Transferring Fund using the NEFT is easy and can be done using both online and offline method. For the offline method, you need to fill an NEFT Transfer form available at the counter and submit the form. The amount will be automatically transferred from the account. For the online method, you need to have internet banking or mobile banking login details. There you can simply login followed by transferring funds using NEFT.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.