State Bank of India is the country’s largest banks. It is also one of the top banks in the public sector. SBI has over 24000+ branches in India and provides a wide range of financial products and services through its huge network in the country and overseas too. The bank’s headquarters is situated in Mumbai.

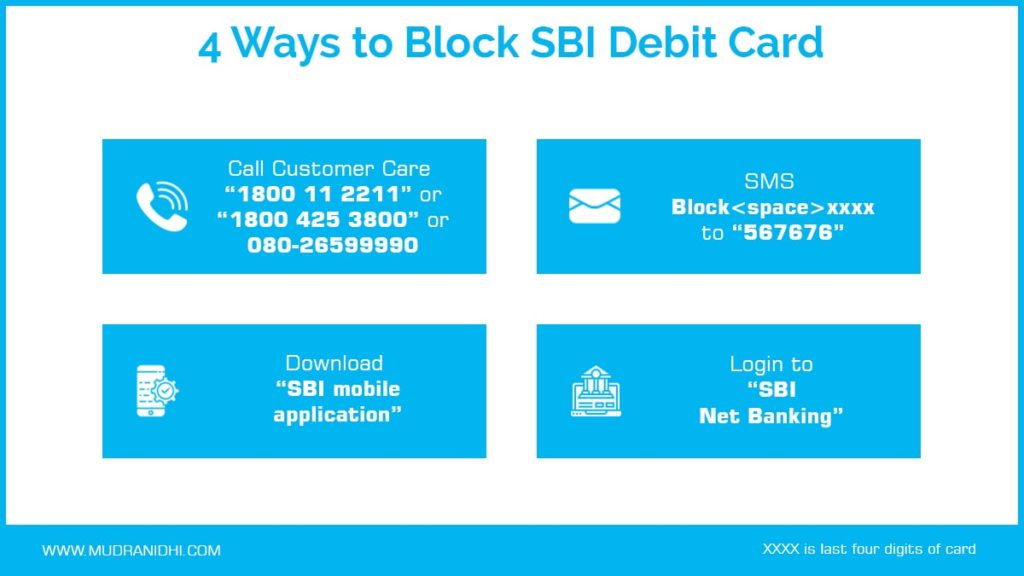

The bank has facilitated world-class banking facilities for its customers. For its customer’s convenience, there are several handy ways which will help you to block your State Bank of India Debit Card. So, you don’t need to panic if you have misplaced your debit card as it is very easy to block it in no time.

New debit cardholders can set up their PIN using Green PIN.

Table of Contents

By calling customer care

Everybody has a mobile phone in this digital age. You can use yours to block your debit card pretty easily. Just dial the following numbers and provide proper information to the customer care representative. They will block your debit card as soon as possible.

Toll-free no. – 1800 11 2211

Toll-free no. – 1800 425 3800

Or 080-26599990

These numbers can be operated from all the networks among all mobile network operators. They also come with 24/7 accessibility.

Block debit card with SMS

Send an SMS in below format with your registered mobile number to get your SBI Debit Card blocked.

Block<space>xxxx and this to 567676

Replace XXXX with the last 4 digits of your SBI debit card. You will get a callback or follow up message which will provide further instructions to block your debit card.

By SBI mobile application

You can download State Bank of India’s official mobile application to block your SBI Debit Card. Customers can download the app from the Google Play Store for Android users. After installation complete the following instructions.

Step 1. Open the app and Log In with your banking credentials.

Step 2. Choose the option Services from the display screen.

Step 3. Now select Debit Card Hotlisting from the options.

Step 4. Select the debit card which you want to block.

Step 5. State the reason for your decision. You can also write a brief note.

Step 6. Now Confirm your action and proceed further.

Step 7. You will get a follow-up message stating the successful submission of your application. Just OK it and you are good to go.

If you get a reference number, keep it for future use. Take a screenshot of the message that appeared.

By using SBI net banking

State Bank of India account holders can visit the official SBI internet banking portal. This can be used to block your debit card. The portal also provides other banking facilities right from the website. Services like fund transfers, mini statements, balance check, and PIN change can all be done directly from the net banking portal.

But for the debit card hot listing specifically, use the following instructions.

Step 1. Log In to SBI net banking with your credentials like Username and Password.

Step 2. Select the e-Services option from the menu screen.

Step 3. Now go to ATM Card Services and choose Block ATM Card from the list.

Step 4. Choose the card which you are willing to block from the list of cards in case you have more than one debit card.

Step 5. Cross-check all the details and Confirm.

Step 6. For further verification choose a mode whether Profile Password or SMS OTP.

Step 7. Enter the OTP or Password as applicable in the credential filling space and Confirm your action.

Step 8. A follow-up message will appear on the screen with a successful submission message.

Keep this reference number handy for future references. You have to keep in mind that all the transactions from your debit card will be blocked immediately.

Final words

Always take the necessary steps to keep your debit card safe. Fraud activities are on the rise nowadays and you could lose your hard-earned money if you do not take it seriously. Block your debit card as soon as you acknowledge the loss and misplacement of the same.

Get a sense of your surroundings when visiting ATM to withdraw cash. Banks always aware of their customers to check suspicious activity in the ATM machine. Debit card misplacement can cause financial damage to the customer. So always keep your card away from the reach of anti-social elements of the society.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.