Constant updating of your bank passbook can be very challenging especially in a business schedule hence, using digital means to keep track of your bank balance can be very useful.

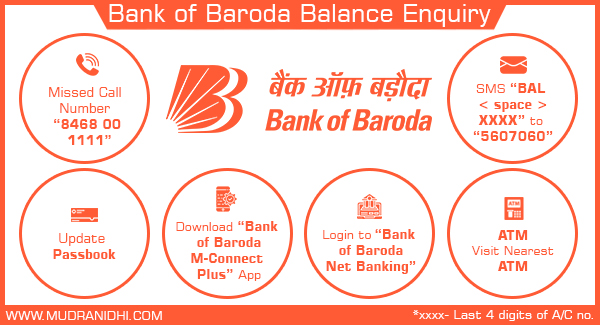

Bank of Baroda provides various methods for you to find the account balance of your account like Net Banking, Mobile Banking, SMS banking, Missed call number, etc.

In this article, we will discuss How to Check Bank of Baroda Account Balance using various methods.

Table of Contents

Bank of Baroda Balance Inquiry Missed Call Number

Bank of Baroda provides the service of missed call alerts wherein the customers can check their account balance directly from their phone. The steps to avail of this service are as follows:

- Visit the nearest Bank of Baroda branch to enroll your contact number for missed call service. The customers can also update their bank account at the time of account creation.

- Once the service is activated, dial the toll-free number 8468001111. The call will be automatically disconnected.

- You will receive an SMS alert that notifies you of the details of the available balance.

Bank of Baroda Mini-Statement using Missed Call Number

You can use missed call number to find the mini-statement using your registered mobile number. The missed call number to find the mini-statement of your BOB account is 8468001122. After giving a missed call on this number, the call will be disconnected automatically and you’ll receive an SMS containing your mini-statement.

Bank of Baroda SMS Banking via BOB SMS Balance Check Number

Bank of Baroda customers can check their account balance with the help of SMS service from their registered mobile number. To avail of this facility, the user needs to send the SMS in a specific format to 8422009988. Once the bank receives this SMS, it will respond with an SMS of its own with the updated balance.

The format for sending the account balance inquiry is as follows:

BAL <space> Last four digits of the account number

For example, if the account number is 1234567890, then type BAL 7890 and send it to 8422009988.

Other SMS Banking Services

| Service | SMS Format |

|---|---|

| Balance Enquiry | BAL < space > XXXX |

| Mini Statement | MINI < space > XXXX |

| Cheque Status | CHEQ < space > XXXX < space > Cheque No. |

| Un-subscribing SMS alert facility | DEACT < space > XXXX |

| Subscribing SMS alert facility | ACT < space > XXXX |

Check Balance using BOB What’s App Banking

Bank of Baroda provides its customers with the What’s app banking service using which you can use the what’s app to use various banking services. What’s app is a communication app that almost everyone uses for communicating with each other. Now, even banks are present on the what’s app to provide the banking service to the users.

You can also find the bank balance of your account using the What’s app baking service by the Bank of Baroda. Just follow these steps to find your bank balance using the What’s App Banking service-

- Open your smartphone and create a contact on your phone with the name Bank of Baroda What’s App Banking and the number- 8433888777

- After that, you’ll have to open the What’s app and search for the Bank of Baroda What’s app Banking number and send a message “Hi“

- After that, you’ll have to choose between the languages i.e. Hindi or English

- Now, an OTP will be sent on your registered mobile number which you’ll have to enter and verify that

- After successful verification, you’ll have to type “BAL” on the chat box and you’ll receive the bank balance of your account displayed on the screen

- Now, you can also find the mini-statement of your account by typing “Mini” on the chat box and you’ll also receive the Mini Statment of your account on the chat screen

Check Balance Using Bank of Baroda Mobile Banking

Bank of Baroda has its own mobile banking app by the name of M-Connect Plus. The app provides a great user interface with a wide range of services that range from third-party transfer to the download of account statements. Here a customer can easily check his or her account balance at any time of the day. This service can be used 24X7 and 365 days without any requirement of a personal bank visit. The app can be downloaded on the registered mobile number both from Google Playstore and the iOS store to empower customers with digital services.

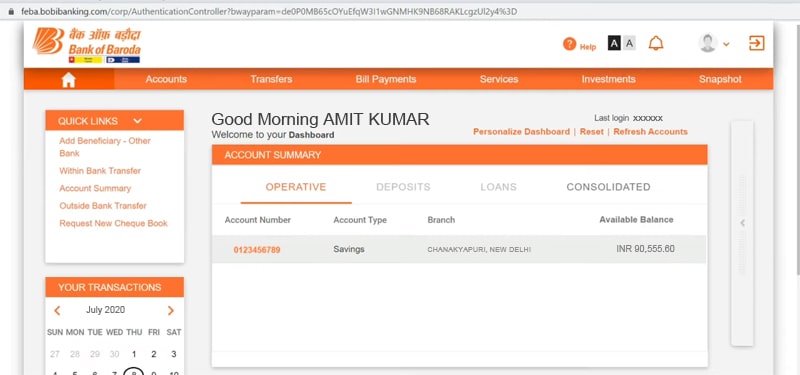

Check Balance Using Bank of Baroda Net Banking

Bank of Baroda customers can also check their account balance through the BOB Net Banking facility all day of the week, and 365 days a year. A customer can easily avail of this facility using an internet connection and a computer with a browser. However, this facility is limited to registered users only. You can apply for a net banking facility at the nearest branch. After registration, the bank will provide the customer with the essential login details that can be used for Bank of Baroda Net banking at www.bankofbaroda.in. Once activated, you can easily avail yourself of this facility any time of the day.

Check Balance Using Bank of Baroda ATM

To use this facility you would need to have an active Bank of Baroda ATM Card. If you do not have this card then you can apply for it in your near Bank of Baroda branch. The card can be used in any ATM machine to check the bank balance. The service is entirely free of any charge. The steps to know the account balance through ATM service is as follows:

- Insert the ATM Card in an ATM Machine.

- The machine would ask for the associated ATM Pin.

- Insert the right pin and press enter.

- Select the Balance Inquiry option to know your available account balance.

Check your Balance by Visiting Your Nearest Bank of Baroda Branch

A customer can also follow the traditional method of visiting the nearest Bank of Baroda branch to check the current account balance. Here the bank executives will help you to update your passbook and you will get a history of all the past transactions along with the existing bank balance.

About Bank of Baroda

Bank of Baroda is India’s international bank with about ten thousand branches spread out across 21 different countries. BOB is the second-largest bank in India, next only to the State Bank of India. This state-owned banking and financial services company was established in the year 1908 by the Maharaja of Baroda, Maharaja Sayajirao Gaekwad III, and later nationalized in 1969 and designated as a profit-making public sector undertaking (PSU).

BOB has a total asset of more than 3.58 trillion rupees and was ranked 1145 on the Forbes Global 2000 list. The bank provides the latest and the best banking services to the customer like Net Banking, Mobile banking, and much more. The bank has won many laurels due to its superior services. Some of them include “Best Public Sector Bank Account” (2015) under the category of Global Business and “Excellence in Banking (PSU Sector)” (2015) at the fifth My FM Stars of the Industry Awards.

FAQ

To find the bank balance of your Bank of Baroda Account by giving a missed call on 8468001111. After giving a missed call, your account balance details will be sent to you via SMS.

You can find the mini-statement of your Bank of Baroda account by giving a missed call on 8468001122. You’ll receive the mini-statement detail vis SMS on your registered mobile number.

You can find the bank balance using various methods like Net banking, mobile banking, SMS banking, etc. The best way of finding the bank balance is using the missed call number that allows you to give a missed call to a number and in return receive an SMS containing your bank account balance details.

You can register your mobile number in Bank of Baroda by visiting the bank branch and filling out the account updating form with your updated mobile number and submitting it to the bank representative.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.