When the advance tax or TDS deduction of the taxpayer is higher than the total tax liability. An intimation showing the amount of refund credited in your account will be sent to the taxpayer via e-mail or SMS. This intimation notice come along with a refund sequence number. It is applicable under section 143 (1) of the Income Tax Act.

If for any reason you have not received the refund amount, then you can raise a request in this situation on the official Income Tax Department e-Filing portal. Below are the reasons for tax refund failure:

- Invalid Address

- Invalid IFSC Code

- Invalid Account Number

- Name mismatch between Individual and Bank account

- Account has been closed.

A refund reissue request must be filed in all the above scenarios.

Table of Contents

How to Check Refund Status?

ITR refund status could be checked both at e-Filing website or NSDL website. You can check your refund status on NSDL website without logging in with your PAN card number only. Here are the steps to check status:

- Open https://tin.tin.nsdl.com/oltas/refund-status-pan.html in your web browser.

- Enter your PAN Card number in the PAN field.

- Select the Assessment Year for the year you want to check your status.

- Enter the Captcha Code from the image.

- Now click on Proceed to see your status.

How to Request for Refund Re-issue

If you find any ITR refund failure message, you can request for re-issue of refund from e-Filing website. Following are the steps you need to go thru:

Step 1: Open the link www.incometaxindiaefiling.gov.in

Step 2: Login to the website by entering User ID, Password, Date of Birth and Captcha code.

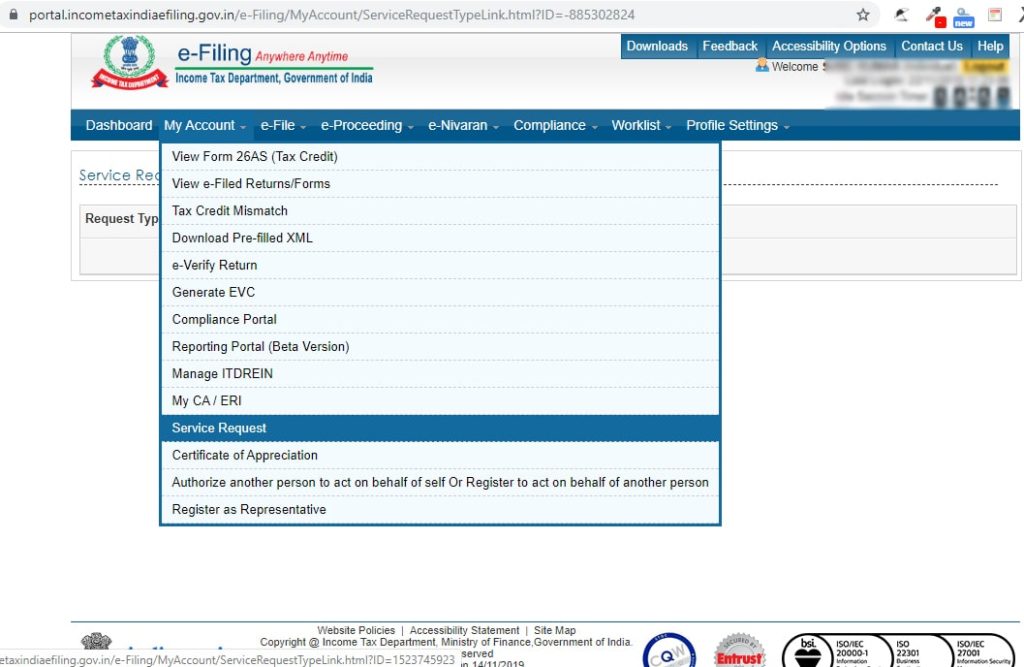

Step 3: Select ‘My Account’ and click on ‘Service Request’ option.

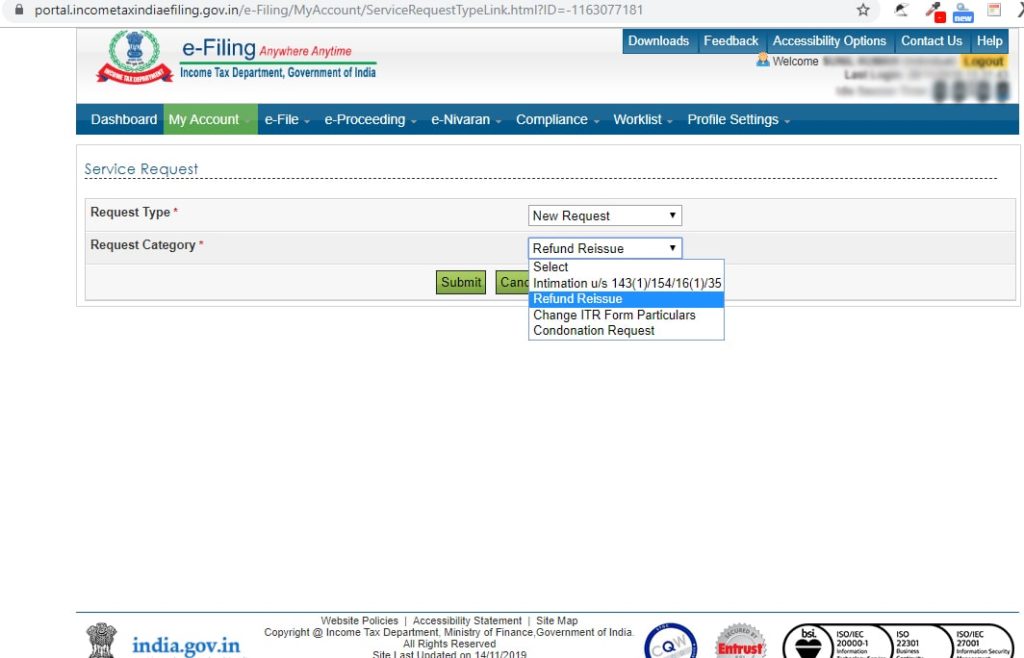

Step 4: Choose the Request type as New Request and select the Request Category as Refund Reissue, then click Submit.

Step 5: Now on the displayed screen click on Submit option located under Response column.

Step 6: Fill all the details in the Bank Account Number, Account Type, IFSC Code and Bank Name.

Step 7: Cross check the details given in the Address sectionand Submit the form.

Step 8: A popup will appear click OK on it. Now choose a mode for e-Verification, generate and use EVC (Electronic Verification Code) or Aadhaar OTP whichever is comfortable for you.

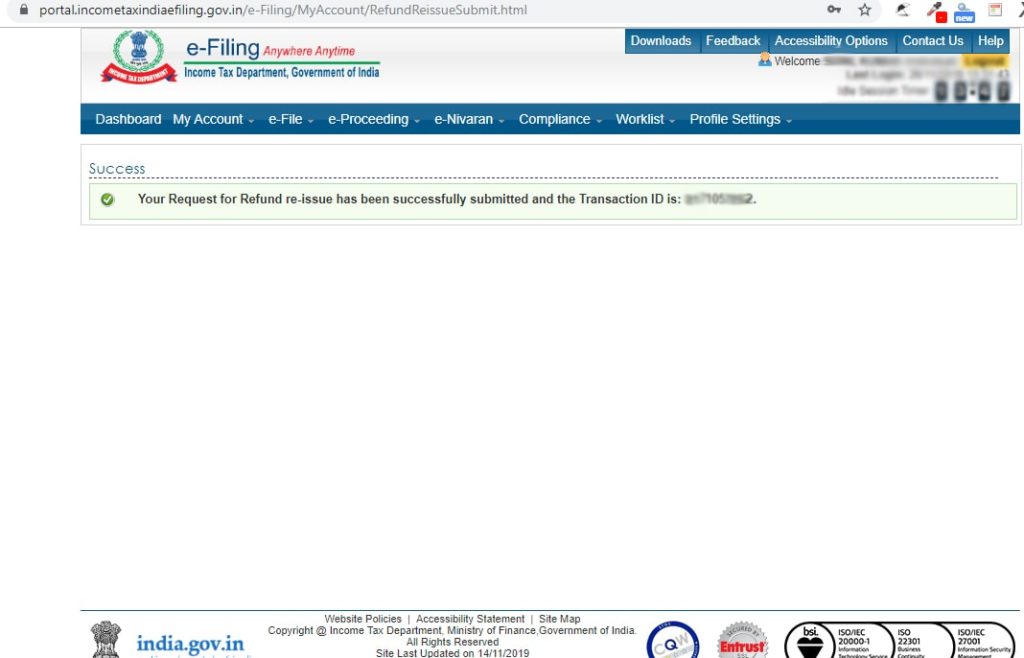

Step 9: Success submission confirmation message for the Refund Re-issue request will appear on your screen.

On successful authentication, you will received acknowledgement email saying ” Request for refund re-issue for XXXXXXXXXX of 2020 has been successfully submitted and the the Transaction ID is xxxxxxxxxx”.

After some days of request submission the refund amount will be credited to your account.

Form 16 for Salaried Employee

For salaried employee submit the Form 16 which you get from your employer. If you don’t know what Form 16 is it is a document which carries the information of TDS deducted from your salary by the employer. Then Income Tax instructs your employer to provide certificate in which TDS deduction details are given. It is a very important document as it helps in the estimation of your accurate tax liability.

How Long ITR Refund Credit Takes?

From the date of E-Verification of your Income Tax Return it will take approximately 20-45 days to get your refund credited.

In case of sending ITR-V, take a printout of ITR form and submit it to Centralized Processing Centre after singing on it within a time period of 120 days from the date of e-filling on online portal.

*If due to any reason your ITR-V doesn’t reach to CPC then you have to mail it again through ordinary or speed post within 120 days of filing your ITR.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.