LIC’s Jeevan Labh is a limited premium paying, non-linked, with-profits endowment plan that provides protection along with savings. In the instance of a premature death of the policy holder, the plan assists the family with fiscal assistance. In this case the beneficiary gets a lump sum amount. The LIC Jeevan Labh plan also takes care of liquidity needs through the loan facility.

Death Benefit

If the policy holder dies prematurely during the policy term, and if all the premiums have been paid in a timely manner, then the beneficiary becomes eligible for Death benefit. This death benefit is defined as sum of “Sum Assured on Death”, the vested Simple Reversionary Bonuses, and any Final Additional bonus. Here, “Sum Assured on Death” is defined as the higher of 10 times of annualised premium or Absolute Amount Assured to be paid on death i.e. Basic Sum Assured. The death benefit would be a minimum of 105 percent of all the premiums paid till the time of death.

The above mentioned premiums do not include any taxes, and extra amount chargeable under the policy owing to underwriting decision and any rider premium(s).

Maturity Benefit

The maturity benefit is a lump sum amount paid to the policy holder at the time of the maturity of policy. The “Sum Assured on Maturity” is equal to the Basic Sum Assured, along with vested Simple Reversionary bonuses and any Final Additional bonus. The policy holder becomes eligible for maturity benefit is all the payments have been paid in a timely manner.

Participation in Profits

The plan is eligible to participate in the Corporation’s profits and is entitled to receive Simple Reversionary Bonuses declared as per the Corporation’s experience, on the condition that policy is in fully active condition.

The final (Additional) Bonus might also be declared under the policy in the year when the policy is claimed either by death or maturity.

Optional Benefit

The policy holder is given an option to avail the subsequent Rider benefit(s):

- LIC’s Accidental Death and Disability Benefit Rider (UIN: 512B209V01)

- LIC’s New Term Assurance Rider (UIN: 512B210V01)

Note: The rider sum assured should always be less than or equal to the basic sum assured.

ELIGIBILITY CONDITIONS and OTHER RESTRICTIONS

Minimum Basic Sum Assured: Rs. 2,00,000

b) Maximum Basic Sum Assured : Unlimited

(The Basic Sum Assured would be in the multiples of Rs. 10,000)

c) Policy Term/Premium Paying Term: (16/10), (21/15), and (25/16) years

d) Minimum Entry Level Age: The policy holder should have completed 8 years of age.

e) Maximum Entry Level Age: (i) The policy holder should have completed 59 years on the nearest birthday for a maximum policy term of 16 years.

(ii) The policy holder should have completed 54 years on the nearest birthday for a policy term of 21 years; &

(iii) The policy holder should have completed 50 years on the nearest birthday for a policy term of 25 years.

f) Maximum Maturity Age: The policy holder should have completed 75 years on the nearest birthday.

Payment of Premiums:

- A policy holder can opt to pay the premiums at regular intervals of monthly, quarterly, half-yearly or annual payments.

- There is an option for both salary deduction and ECS.

- The plan has a provision for grace period during delay in payment. In the instance of monthly premium payments, the grace period is fifteen days, while in the instance of other types of payments the grace period is thirty days.

Sample Premium Rates:

Following are some of the sample annual tabular premium rates (in rupees) (exclusive of service tax) per Rs. 1000 Basic Sum Assured:

|

Age (in years) | Policy Term/Premium Paying Term (in Years) | ||

| 16 (10) | 21 (15) | 25 (16) | |

| 20 | 85.20 | 54.50 | 45.95 |

| 30 | 85.50 | 54.95 | 46.60 |

| 40 | 86.80 | 56.80 | 48.90 |

| 50 | 90.95 | 61.85 | 54.80 |

MODE and HIGH S.A. REBATES

- Mode Rebate:

- There is a mode rebate of 2 percent of tabular premium on annual mode.

- There is a mode rebate of 1 percent of tabular premium on half-yearly mode.

- There is no rebate on quarterly and monthly modes.

- High Sum Assured Rebate: The policy also has a provision for high Sum Assured Rebate.

- There is no rebate on Basic Sum Assured value of 2 lakh to 4.9 lakhs.

- There is 1.25 percent rebate on Basic Sum Assured value of Rs. 5 lakh to Rs. 9.9 lakhs.

- There is 1.5 percent rebate on Basic Sum Assured value of Rs. 10 lakhs to Rs. 14.9 lakhs.

- There is 1.75 percent rebate on Basic Sum Assured value of Rs. 15 lakhs onwards.

REVIVAL

- In the absence of premium payments (that surpasses the grace period) a policy may go into a relapse state. However, the LIC Jeevan Anand plan has the provision of revival of policy within a two-year period from the policy relapse date (that is the date of first unpaid premium) provided the plan is still active and there is some time for expiration date.

- To revive this policy, the plan holder would have to make a payment of all the missed premiums along with the corresponding interests (the interest compounds on a half-yearly basis and is fixed by the corporation). The interest incurred on the missed premiums is clearly communicated to the policy holder.

- The corporation has the right to accept the revival of the policy (i) at the original term, or (ii) at a revised term, or (iii) decline the revival request.

- The policy would only be revived after getting approval from the corporation and the acceptance (or rejection) of the revival would be communicated to the applicant.

- If the policy holder wants to revive the accompanying rider of the plan, then this revival of rider would be considered along with the revival for the plan and not in isolation (that is you cannot revive the rider without reviving the plan).

PAID-UP VALUE

- The plan transforms into a paid-up form if the policy holder had paid at-least three years of premiums without paying any additional premiums.

- The Paid-up form saves the policy from going into a void state.

- There will be a reduction in the original Basic Sum Assured amount and this new amount would be known as “Paid-up Sum Assured”. This Paid-up Sum Assured would have the same ratio to the Basic Sum Assured as the ratio of the premium paid to the total number of payable premiums. Hence, the value would be equal to

Basic Sum Assured X (number of premiums paid) / number of premiums payable.

- The Paid-up Sum Assured added with any vested simple reversionary bonuses would be paid to the beneficiary on the expiry of the policy term or in the instance of a premature death.

- Any revisionary bonus that was earlier added to the policy on the date of paid-up would continue to exist as an attachment to the policy.

- There will be no further bonuses to a paid-up plan.

- In the instance of death, the “Death Paid-up Sum Assured” shall be paid and the amount will be equal to [Sum Assured on Death * (number of premiums paid / number of premiums payable during the premium paying term)].

- There are no paid-up values on the rider(s) and hence, if the policy goes into a relapse state then the rider benefits cease to exist.

SURRENDER VALUE

- The policy holder can surrender the policy for cash benefits on the condition that at least three years premiums have been paid.

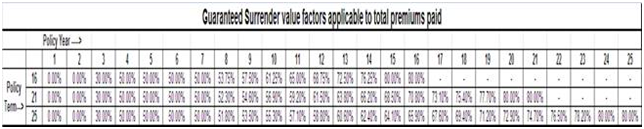

- In the course of the premium term, the Guaranteed Surrender value would be certain percentage of overall premiums paid (net of service tax) without taking into account the added premiums and any opted rider premiums. The percentage would be dependent on the duration of the policy along with the year in which the policy is surrendered as listed below:

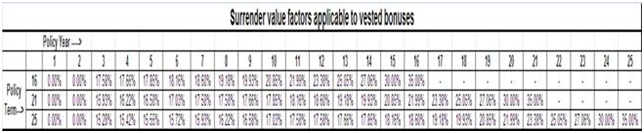

Additionally, the surrender value of any vested simple reversionary bonuses would also be payable. This amount is equivalent to vested bonuses multiplied by the surrender value factor applicable to vested bonuses. The factors are dependent on the policy duration and policy year in which the policy is surrendered and are mentioned as written underneath:

In certain cases, the corporation might also pay Special Surrender value, if it is more favorable to the policy holder.

POLICY LOAN

- The plan is eligible for loan on the condition that it has acquired a minimum surrender value.

- The loan value is subject to the terms and conditions of the company and could change at any moment of time during the policy term.

TAXES

- Policy would incur the relevant taxes including Service Tax.

- The tax would be as per the Tax laws and the rate of tax would differ on the basis of government mandate from time to time.

- The policy holder is mandated to pay the tax value according to the prevailing government rates. The tax would also be eligible on any added premiums.

- The amount of tax paid would not be taken into account for the calculation of benefits payable under the plan.

FREE-LOOK PERIOD

- The plan has a provision of cooling-off period wherein the policy holder could return the plan within a fifteen day period from the date of plan purchased.

- To return the plan, the policy holder would have to state in writing the reason for objection in the continuation of plan.

- Once the request for return of plan is submitted at the Corporation, the Corporation cancels the policy and gives back the total premium amount deposited for the purchase of plan after subtracting the equivalent risk premium (for basic plan and any rider(s)) for the cover duration, expenses sustained on medical examination and any special reports, and the stamp duty.

EXCLUSION

Suicide: – In the instance of suicide, the policy would be deemed void.

- In the instance of suicide within a 12 months period from the date of commencement of risk, the Corporation would pay just the sum of 80 percent of the premiums paid. This sum is exclusive of all taxes and any added premium and rider premiums, and is given out on the condition that the policy is fully effective.

- In the instance of suicide within a 12 months period from the date of revival, an amount that is higher of 80 percent of the premiums paid till the date of death (exclusive of any taxes and any extra premium and rider premiums) or the surrender value is paid to the beneficiary on the condition that the policy is in effect. There will not be any other compensation under this policy.

- You can find out more by contacting the LIC customer care regarding this LIC Plan

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.