Electric vehicles are the future that we are going forward to and India being the fastest growing economy and a developing nation does not want to lag behind.

To fast track electric vehicle adoption, the Government of India provides attractive subsidies to make people adopt e-vehicles fast.

You can avail of these subsidies and the overall upfront cost of the electric vehicle will be reduced which happens to be one of the hurdles faced by the people.

Another major setback that an electric vehicle owner can face is the lack of Electric infrastructure to facilitate the e-Vehicle, nevertheless, the Government of India is pushing aggressively to develop the electric infrastructure to develop the EV Market in the country.

The Government of India during the COP21 summit held in Paris made a commitment to reduce carbon emissions to 33-35% by 2030.

Developing an e-Vehicle market is a step that has been taken to support the commitment made by India in an international forum for climate change.

Indian Auto-manufacturers are also supporting the Government by researching and developing new models of electric vehicles for the customers along with establishing charging stations all over the country.

In this article, we will discuss how to avail subsidies on Electric vehicles.

Table of Contents

Subsidies on Electric Vehicle

The Government provides amazing subsidies on Electric vehicles which makes them an attractive option for consumers.

There are two types of subsidies that you’ll get provided by the State Government and Central Government, which is as follows-

State-Wise Subsidies Provided By The State Governments

The following are the subsidies provided by the state governments-

| State | Vehicle Type | Subsidies per kWh | Other Benefits | Max Cap |

| Delhi | 2 wheel | Rs.5000/- | waived off the registration fees and road taxScrappage benefits up to Rs. 5,000/- | Rs.30,000/- |

| 3 wheel | Rs.30,000/- Total | Rs.30,000/- | ||

| 4 wheel | Rs.10,000/- | Rs.1.5 Lakhs | ||

| Gujarat | 2 wheel | Rs.10,000/- | waived off the registration fees and road tax | Rs.20,000/- |

| 3 wheel | Rs.30,000/- Total | Rs.50,000/- | ||

| 4 wheel | Rs.10,000/- | Rs.1.5 Lakhs | ||

| Maharashtra | 2 wheel | Rs.10,000/- | Rs 15,000 early bird incentive + Rs 7,000 scrappage + Rs 12,000 other incentives Registration and road tax exemption | – |

| 3 wheel | Rs.30,000/- Total | Rs 25,000 scrappage + Rs 1.5 lakh early bird incentive Registration and road tax exemption | – | |

| 4 wheel | Rs.10,000/- | Registration and road tax exemption | – | |

| Rajasthan | 2 wheel | Rs.5,000/- for battery capacity Rs 2 kWh Rs.10,000/- for battery capacity more than 5 kWh | Exemption of SGST | – |

| 3 wheel | Rs.10,000/- for battery capacity less than 3 kWh Rs.20,000/- with more than 5 kWh | Exemption of SGST | – | |

| Meghalaya | 2 wheel | Rs.10,000/- | Registration and road tax exemption | – |

| 4 wheel | Rs.4,000/- | Registration and road tax exemption | – | |

| Karnataka | 2 wheel | NA | Registration and road tax exemption | – |

| 3 wheel | NA | Registration and road tax exemption | – | |

| 4 wheel | NA | Registration and road tax exemption | – | |

| Andhra Pradesh | 2 wheel | NA | Registration and road tax exemption | – |

| 3 wheel | NA | Registration and road tax exemption | – | |

| 4 wheel | NA | Registration and road tax exemption | – | |

| Telangana | 2 wheel | NA | Registration and road tax exemption | – |

| 3 wheel | NA | Registration and road tax exemption | – | |

| 4 wheel | NA | Registration and road tax exemption | – |

Subsidies Provided By Central Government

Central Government provides FAME-II subsidies for electric vehicles, It’s an acronym for Faster Adoption and Manufacturing of Hybrid and Electric vehicles.

In this scheme, the Central Government under the EV policy by the Department of Heavy Industries would provide the following subsidies for the purchase of the Electric Vehicles in India-

- Two-Wheel Electric Vehicle- Rs.15,000 per kWh of battery capacity (Maximum up to 40 percent of the vehicle cost)

- Three-Wheel Electric Vehicle- Rs.10,000 per kWh of battery capacity (Maximum up to Rs 1.5 lakh)

other incentives that the vehicle owner gets while purchasing the electric vehicle are-

- The GST charges on the Electric Vehicle will be on the lower side at 5%

- If the customer is taking a loan then he/she will get tax benefits of up to Rs 1.5 lakh under Section 80EEB of the Income Tax Act.

Final Cost to the Customer with EMI

To give you a perspective on how much you’ll save on purchasing the EV vehicles we will take an example of the best selling electric vehicle by Tata Motors- TATA Nexon XM EV with an Ex-showroom price of Rs.13,99,000/-

Let’s Calculate the subsidies provided by the Government on the purchase of Tata Nexon XM EV in Delhi.

The battery capacity of Nexon EV is 30.2KWh and the Delhi Government provides a subsidy of Rs.10,000/- per kWh. The total cost adds 30.2X10,000= 3,20,000/-, but there is a maximum cap of Rs.1.5 lakhs, therefore, the total subsidy provided by the Delhi Government is Rs.1.5 Lakhs

Now, the Central Government also provides Rs.10,000 per kWh battery capacity, therefore, the central government also provides Rs.1.5 Lakhs, both of the subsidies add up to Rs. 3 lakhs.

The total cost of TATA Nexon is Rs. 13,99,000 and when we subtract Rs. 3 lakhs, the final amount that you have to pay is Rs.10,99,000.

Since the road tax and registration fee are also exempted, the cost will be somewhere around 11 lakhs.

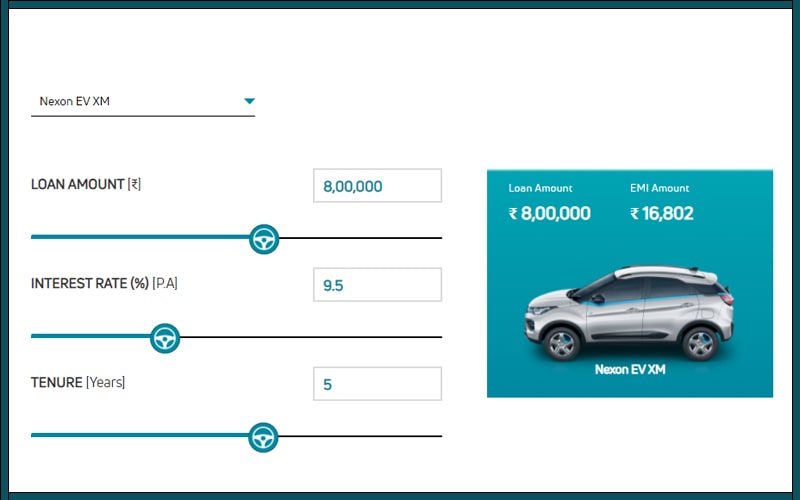

Now, if you want to take a car loan with a down payment of 2 lakhs then the calculation of the EMI is as follows-

At the interest rate of 9.5%, you’ll have to take a total loan amount of 8 lakhs. When we calculate the EMI for a tenure of 5 years, the amount payable is Rs.16,801/- which is very affordable.

Now, all these calculations can change depending on different situations. If you are paying more money as down payments then EMI cost will come down.

If you want to calculate your Car EMI then you can use our Car Loan Calculator.

The subsidies provided by the government can be availed right when you purchase your vehicle, the manufacturer will sell you the subsidies vehicle and the subsidy amount will be paid by the government directly to the manufacturer.

Internal Combustion Engine (ICE) vs Electric Vehicle

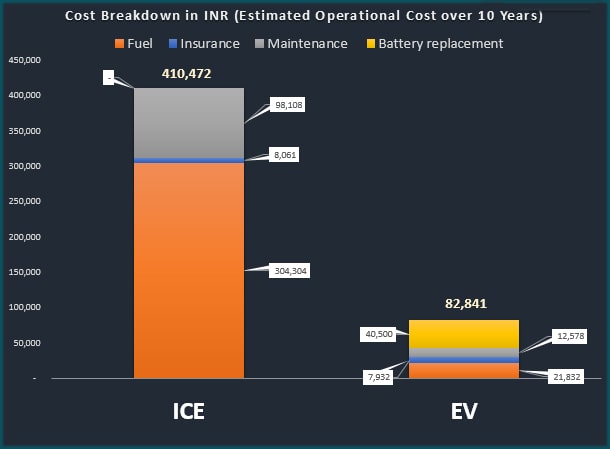

Below, we have calculated the total cost of ownership that ICE and EV vehicles pose on the owner. These calculations are an estimate and pricing may go up and down depending on the situation.

Let’s compare the cost of ownership of TVS Jupiter and Ather 450+ that uses petrol and electricity as fuel respectively.

| Select ICE vehicle Model | TVS Jupiter |

| Select EV vehicle Model | Ather 450+ |

| Cost of ICE Vehicle selected | Rs.82.508/- |

| Mileage of ICE vehicle selected | 62 Kmpl |

| Cost of EV Vehicle selected | Rs. 1,38,185/- |

| Upfront subsidy under FAME India Phase II Scheme | Rs.27,000/- |

| State-level subsidy | Rs.30,000/- |

| The actual cost of an Electric Vehicle (including subsidy) | Rs.81,185/- |

| Fuel cost for ICE Vehicle | Rs.100/- |

| EV home charging tariff (As per State Tariff Order) | Rs.4.5/- |

| Per day distance traveled | 50 |

The average cost of petrol is Rs.100/- per liter and the cost of electricity per unit is Rs.4.5 in Delhi, you can see a huge difference already in the cost. Also, the mileage of electric vehicles is way more than a traditional ICE engine.

All these factors add up to make electric vehicles a cheaper option in the long run.

Below, the chart depicts the cost of ownership of an electric vehicle and a normal ICE vehicle based on the above chart-

As you can clearly see when we calculate the overall cost of Maintainance, insurance, fuels, etc. we came to these surprising numbers.

A vehicle with a petrol engine costs Rs.4,10,472/- over 10 years and an electric vehicle costs Rs.82,841/- during the same period.

This is a huge difference, it can cover the upfront cost of the e-vehicle 5 times within 10 years comparatively, the vehicle with a petrol engine would push you to the deficit making you pay 3 times more from your pocket.

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.